Accurate, Real-Time Data on Capital Markets

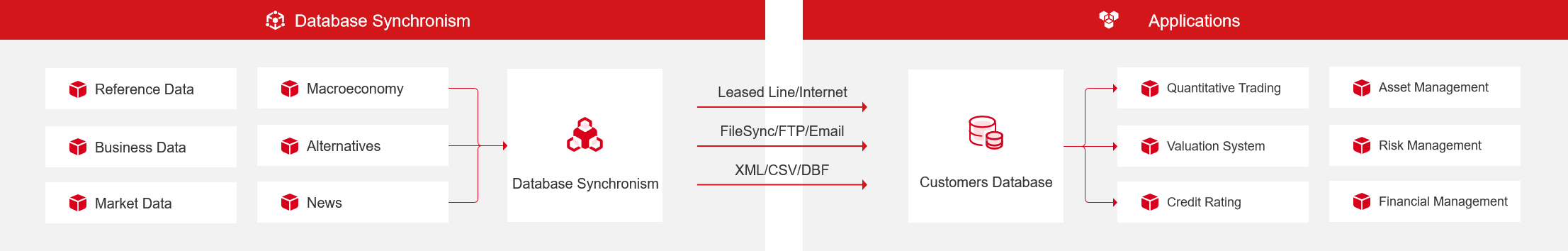

Database Synchronization

Data synchronization client

Features and advantages

Comprehensive support for various scenarios

Standard and user-friendly data structure

Efficient and practical synchronization system

Flexible and convenient module subscription

Personalized and tailored service

Preferred choice for financial talents

Data dictionary

System support

Quantitative trading system

Risk management system

Asset management system

Financial management system

Valuation system

Credit rating system